At Priora® we believe:

You are very committed to the success of your business.

You are searching for a method to truly understand and manage the cash flow of your business.

You know you should have a better working knowledge of your cash flow.

Our vision for you is: “Applying Financial Literacy®”

We believe you should be sleeping better at night, knowing:

- You understand how your daily business decisions impact your cash flow.

- Your cash flow is adequate to meet upcoming obligations.

- You are building and maintaining a stronger banking relationship.

We believe you can:

- Develop better strategic and financial plans.

- Develop more competitive pricing and still make a profit.

- Afford to develop a successful marketing plan.

We believe you will:

- Achieve improved cash flow through increased profits.

- Retain better qualified employees.

- Position your business for sale.

PRIORA® BUSINESS FEATURES:

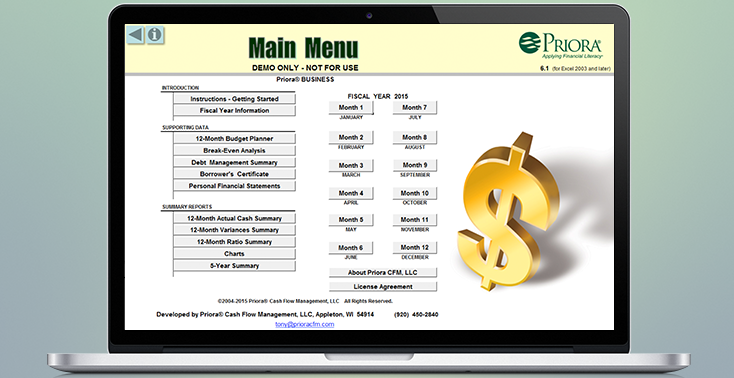

Main Menu

The Main Menu is the center of the system showing the components of the Priora® Business. Each of the 12 months of the year are shown in the right half of this image. The Introduction contains instructions, definitions and a place to set the current Fiscal Year for the report. Read More

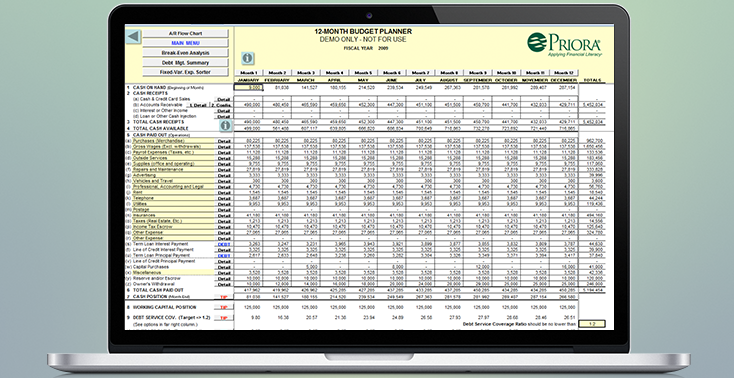

12-Month Budget Planner

The 12-Month Budget Planner represents the revenues (top rows totaled in Row 4) less the cash expenses totaled on Row 6, leaving the cash remaining at the end of the month (Row 7). Notice Rows 8 through 13 include the key ratios that drive the measurement of cash flow. Section 14 includes balance sheet information necessary to calculate these ratios. Data can only be entered in yellow cells in Priora® Business. Read More

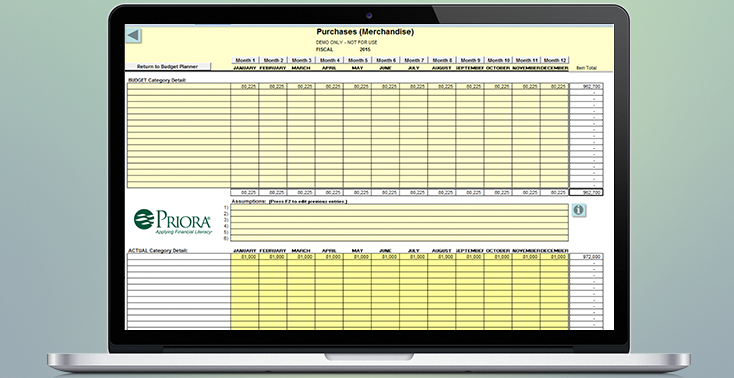

Purchases Screen

The Purchases (Merchandise) screen is an image of one of the “Detail” pages when the “Detail” button is clicked. It is here, in the upper portion, the budgeted amounts are entered for each month of the year. The lower portion is where the ‘actual’ data is entered from the accounting system being used by the business. The most important part of any budget is the center box called “Assumptions.” Read More

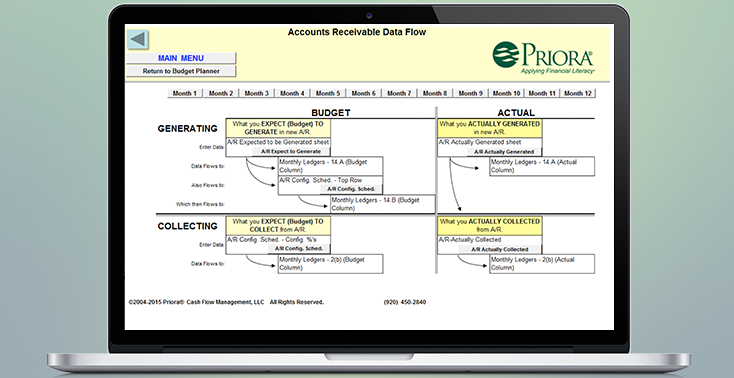

Accounts Receivable Data Flow

The Accounts Receivable Data Flow is very important because it determines the rate at which the accounts receivable will be collected. The instructions for this page are detailed and easy to follow. Each quadrant in this image has a button to a corresponding page in Priora® Business to budget and manage the generation of and collection of accounts receivable. Read More

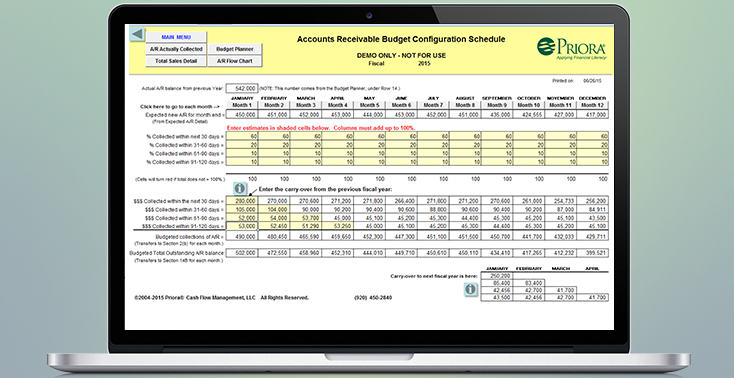

Accounts Receivable Budget Configuration Schedule

Accounts Receivable Budget Configuration Schedule is where the A/R data comes together and the aging of accounts receivable is estimated, based on the actual experience of the borrower. The percentages collected can be modified during the year, for the remaining portion of the year. Read More

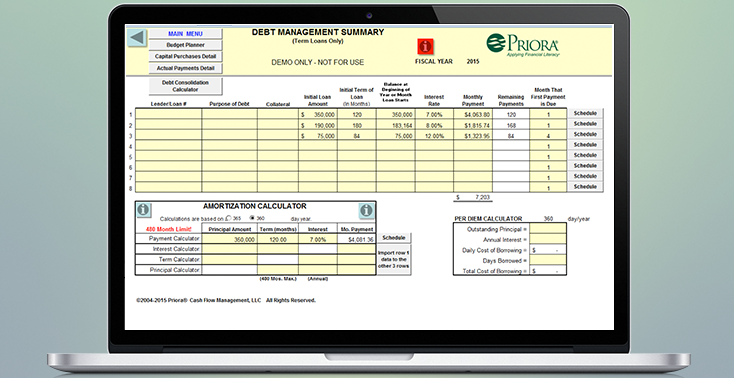

Debt Management Summary

The Debt Management Summary page is a powerful tool to manage an unlimited number of debts (hopefully you don’t have that many debts). On this page is an Amortization Calculator that will determine the monthly payment based on either a 360 day or 365 day year. The calculator provides the ability to solve for any of the four components in a debt – the principal, the term, the interest rate or the monthly payment. Read More

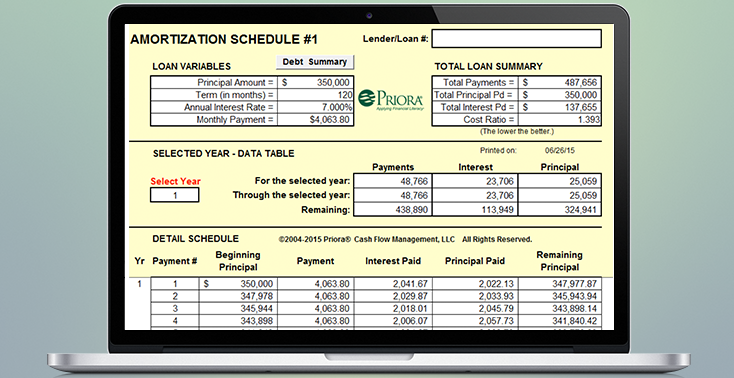

Amortization Schedule

The Amortization Schedule includes an analysis of the total cost of a loan based on the terms of that loan. This page is very useful in determining the best payment plan that can comfortably be supported by the cash flow of the business. It provides the owner of the business with an understanding of how to reduce the total cost of any one or several loans the business is or is projected to carry. Read More

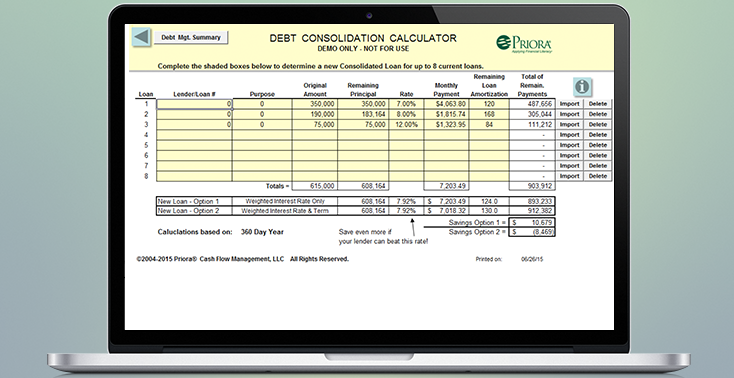

Debt Consolidation Calculator

The Debt Consolidation Calculator is a very powerful debt management system. It permits the owner of the business to combine an unlimited number of loans into one loan (four notes are combined into one note), using two methods. The first method is to calculate the weighted average interest rate for all loans, solving for a new amortization of the outstanding balance of all debt. Read More

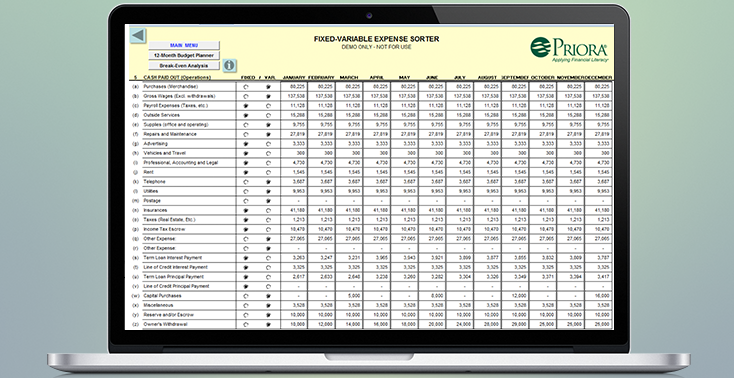

Fixed-Variable Expense Sorter

The Fixed-Variable Expense Sorter is the first step to determining how many units must be sold at what price to make what profit? This is a snapshot of the monthly costs as developed in the 12-Month Budget page. On this page the business owner defines the cost as a Fixed Cost (a cost that must be paid whether any sales occur or not) or a Variable Cost (a cost that occurs in direct proportion to the amount of sales). Read More

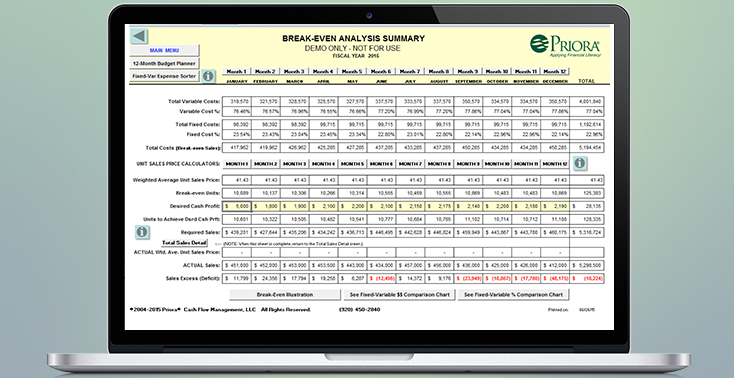

Break-Even Analysis Summary

The Break-Even Analysis Summary page shows the Variable Cost and Fixed Cost percentages. This is very important as the Fixed Cost percentage, combined with the desired Profit, constitutes the Contribution Margin (will be seen on the Break-Even Illustration page). Note that on this page the business owner defines his/her desired profit for the month. Read More

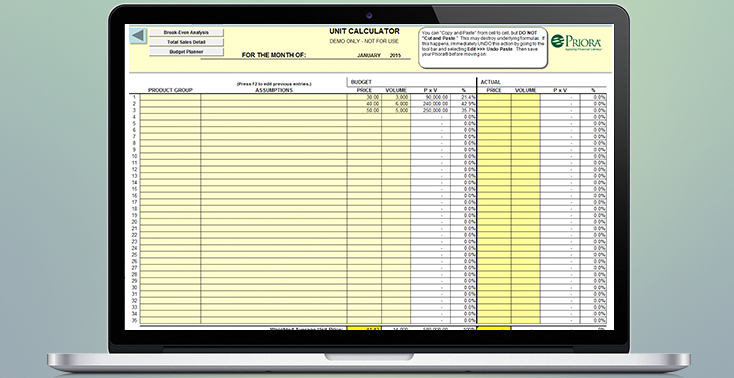

Unit Calculator

The Unit Calculator page is where the Weighted Average Unit Sales Price is determined. Note that it will consider 35 items, categories, departments, etc. Note also that this is not only a budget item, but the actual data can be entered each month to show how Actual sales compared to the Budgeted sales. This page will also be visited often as the business owner determines the proper pricing to not only generate the desired profit, but to do this an remain competitive. Read More

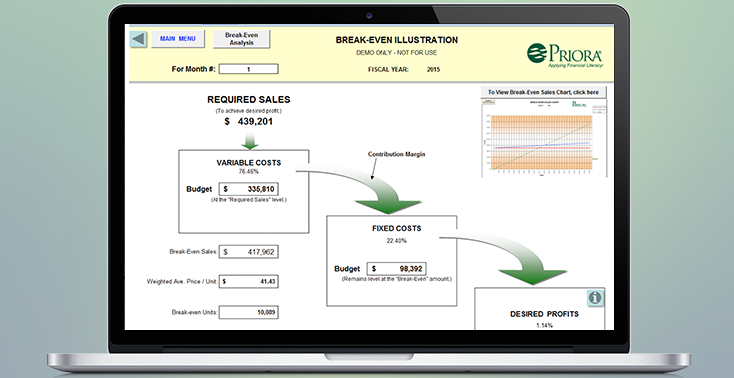

Break-Even Illustration

The Break-Even Illustration page is perhaps the most educational page in the system. It clearly illustrates the impact of Fixed and Variable Costs on the profitability (really, the Cash Flow) of the business. On this page, the Variable Cost Percentage shown in the Variable Costs box is a constant figure. It will not change unless the owner changes costs in the Budget. The Fixed Costs box also contains a Fixed Cost Percentage. But the more important figure in this box is the dollar amount. Read More

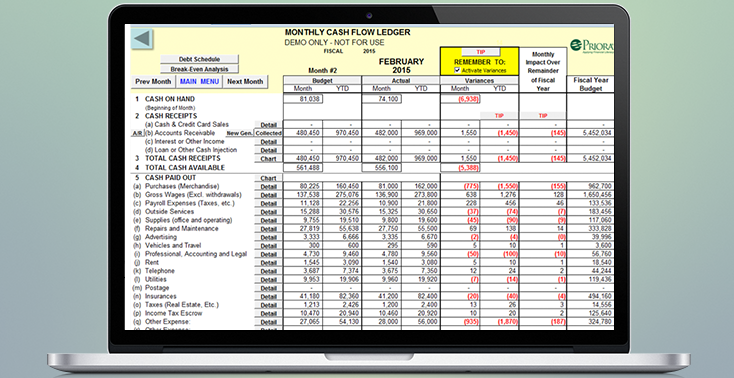

Monthly Cash Flow Ledger

A very valuable report for both the business owner and the lender. The Monthly Cash Flow Ledger is generated by Priora® Business when the data in the Actual column for the Month is entered from the business accounting system – manually by the owner. This page prints on one 8.5 x 11 page of paper. Read More

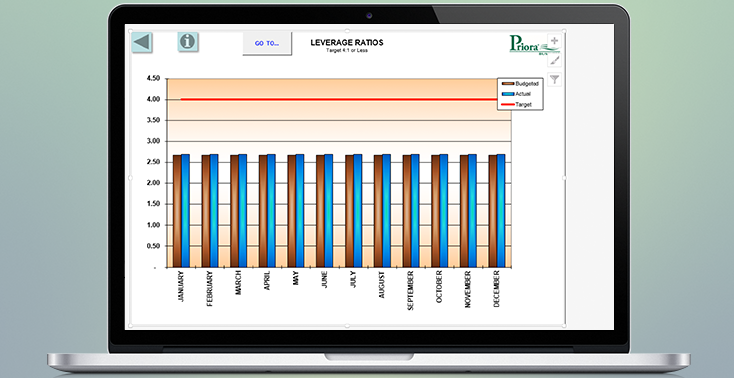

Leverage Ratio Graphs

Priora® Business produces nine graphs to illustrate key ratio performances. Accumulating monthly, these graphs will illustrate “Actual Cash Position”; “Total Cash Receipts”; “Total Cash Paid Out”; “Working Capital Position”; “Quick Ratio”; “Current Ratio”; “Line of Credit Summary”; “Leverage Ratio”; and “Debt Service Coverage Ratio.” Illustrated here is the graph illustrating the “Leverage Ratio.” The red line indicates the limit not to exceed, set by the business owner. Read More

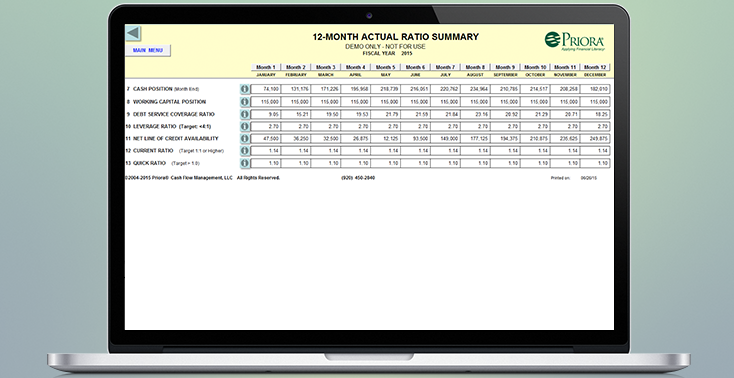

12-Month Actual Ratio Summary

The 12-Month Actual Ratio Summary is a ‘dashboard’ of all the key ratios. The “I” buttons contain definitions of each ratio and an explanation of how they are applied. Having these key ratios on one page presents the user with the ability to determine how the business is truly performing. One must learn how to read and evaluate these ratios. Read More

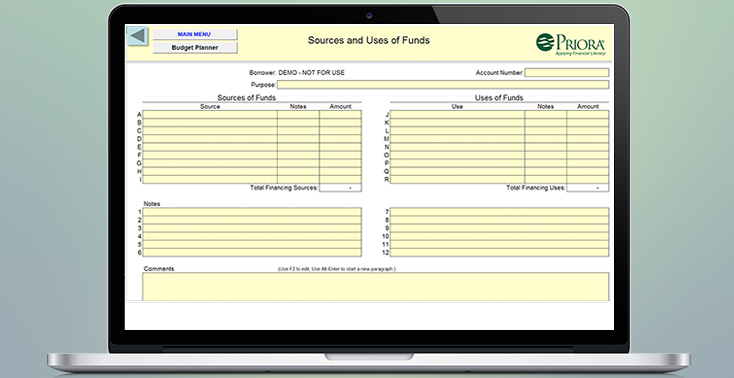

Sources and Uses of Funds statement

The Sources and Uses of Funds statement is critical in informing the lender how much money is required for the project. It breaks down the amount of money the borrower will inject as equity in the project and illustrates how much money is to be borrowed. This report also illustrates where the funding for each us is coming from. Read More